CITI has expressed its appreciation to the Government for the landmark decision to rationalise the Goods and Services Tax (GST) structure into two slabs of 5 per cent and 18 per cent by removing the 12 per cent and 28 per cent slabs. It stated that this reform is a highly progressive step that will not only simplify the existing tax regime but also enhance compliance ease for businesses across the value chain.

At present, the textile & apparel sector is facing several challenges related to the existing GST structure which is not only affecting its growth but also restricting certain segments from realizing their full potential and hence needs to be addressed on a fast-track basis.

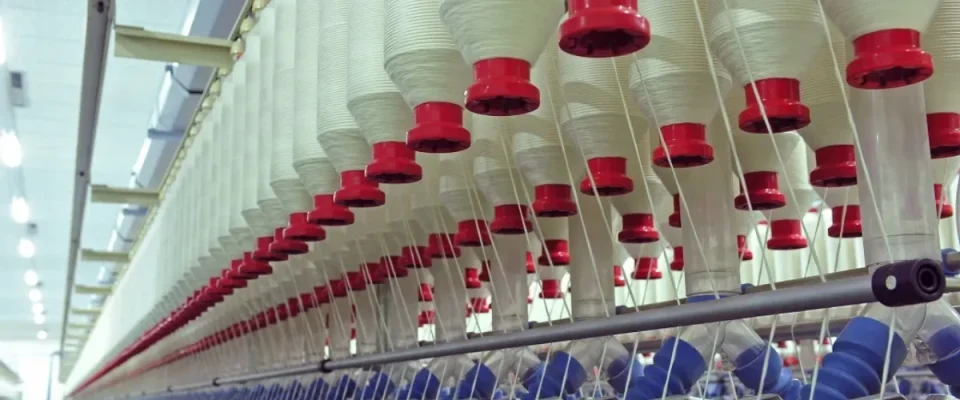

While cotton value chain is under 5 per cent GST slab, MMF value chain faces issue of IDS with fibre being charged at 18 per cent GST, yarn at 12 per cent and fabric at 5 per cent. This IDS is not only leading to capital blockage in the MMF industry but the prevailing disparity in GST slabs between the cotton and MMF (man-made fibre) value chains continues to adversely impact the balanced growth of the textile and apparel (T&A) industry.

News Courtesy: Fibre2fashion